- European Commissioner Elżbieta Bieńkowska

E-mobility transition driven by climate change legislation

In its efforts to combat climate change, the EU has set the target of achieving carbon neutrality by 2050. At present the transport sector accounts for over 25% of the EU’s CO2 emissions, including 20% from road transport, and is the only major sector of the economy that has seen CO2 emissions rise since 1990. As part of its wider policy goals relating to the environment, the EU is placing increasingly stringent legislation on the transport sector to substantially reduce its emissions over the next decade with significant fines awaiting any manufacturer which doesn’t meet the relevant targets.

EU CO2 emissions by sector (1990 level = 100):

- Energy Industries

- Industry

- Residential and services

- Agriculture

- Transport

- Other

- Total

Transport accounts for 27% of total EU CO₂ emissions including 20% from road transport alone

Source: The EU, company

EU vehicle CO2 emission targets to 2030 (indexed to 100):

- Passenger cars

- Light commercial vehicles (vans)

- Heavy duty vehicles

By 2030 (vs. 1st target):

- Cars: -68%

- Vans: -42%

- Trucks/buses: -30%

Source: The EU, company

FACTBOX - The Auto Industry in the European economy

The region’s auto industry is a major part of Europe’s economy. The sector employs (directly and indirectly) 14.6m people, equivalent to 6.7% of all jobs in the EU, and generates turnover equivalent to 7% of the EU’s total GDP, and a €74 billion trade surplus. There are over 226 vehicle assembly plants spread across 27 countries in the region, producing over 18.5 million vehicles per year for the local market and export. The industry is also the EU’s largest investor in R&D, spending around €61 billion annually equivalent to 28% of total R&D spend in the area.

Europe is already established as a major EV market

Europe is already the second largest market for EVs globally with 2.33 million plug-in vehicles sold in 2021. Significant penetration rates have already been achieved in several European countries with an overall penetration rate of 17% achieved across the EU and EFTA last year.

Driven by legislation and consumer demand, European auto manufacturers are investing heavily in retooling manufacturing plants, securing battery supplies, and developing extensive new model ranges to bring electric vehicles to the mass markets for passenger and commercial vehicles. Overall, the number of EV models available to European buyers is forecast to rise from around 100 today to over 300 by 2025.

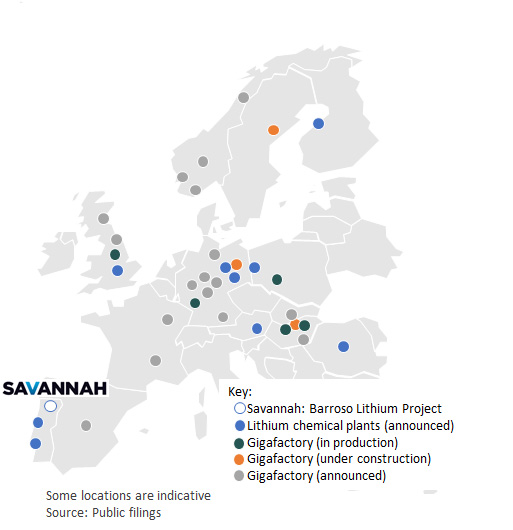

With demand for lithium set to grow in all major markets around the world, and supply forecast to be under pressure to keep pace, the EU and European-based end users are keen to catalyse the development of a dedicated local lithium supply industry, founded on raw material from sustainable, well managed, sources within the region. Savannah’s Barroso lithium project, the most significant spodumene project in the EU, is ideally placed to contribute to this surge in demand. Benefitting from excellent local infrastructure in northern Portugal, the Barroso Lithium Project could supply up to 200,000t per annum of high quality, chemical grade, lithium concentrate which would form the first step in the production of LIBs for use in the European auto industry. Savannah’s annual production of concentrate would provide sufficient lithium for approximately 0.5 million vehicle battery packs.